Who Pays for CalPERS Pensions?

How Public Employee Pensions Are Funded

Some people believe that taxpayers fund the total cost of public pensions. This isn’t true.

The largest contribution comes from CalPERS' investments, with additional funding from employer and employee contributions. Some workers currently contribute up to 17% of their paychecks to help fund their own pensions.

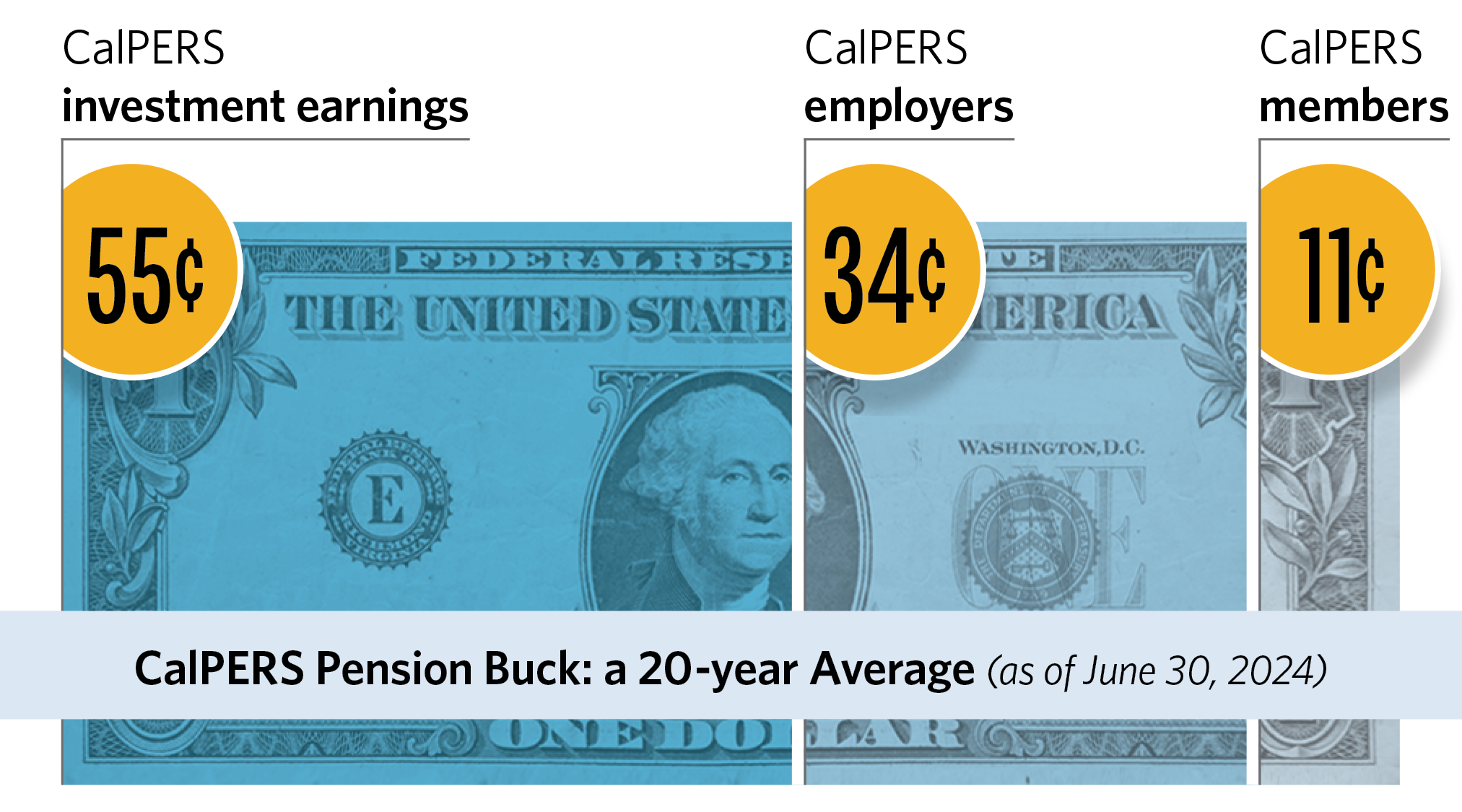

The CalPERS Pension Buck illustrates the sources of income that fund public employee pensions.

Based on a 20-year average ending June 30, 2024, for every dollar CalPERS pays in pensions:

- 55 cents from investment earnings

- 34 cents from employer contributions

- 11 cents from employee contributions

In other words, 66 cents out of every public employee pension dollar is funded by CalPERS' own investment earnings and member contributions. In the fiscal year ended June 2024, CalPERS paid out more than $32 billion in pension benefits.

Pension Payments Contribute to Local Economies

As CalPERS retirees spent their monthly pension benefit payments in FY 2022-23, they supported California's economy, generating $30.2 billion in economic activity, which:

- Supported 139,188 jobs

- Generated $1.4 billion in tax revenue for local industries

- Supported local community growth

Source: Economic Impacts of CalPERS Pensions in California, FY 2022-23